Toronto, unbridgeable fiscal hole without Province and federals

TORONTO – The City of Toronto is not out of the woods yet when it comes to economic challenges and there are some key issues that will need to be answered in the year ahead.

As is well known, the City declared in August that it would face a deficit of $46.5 billion over the next 10 years, including an operating deficit of $1.5 billion for 2024 and $29.5 billion dollars of capital needs.

A sigh of relief should come from the recent agreement with the Province, which is expected to provide $7.6 billion in capital aid over the next few years, as well as hundreds of millions of dollars to operate shelters and transportation. But it won’t be enough.

A pressing issue for the foreseeable future is that the City is still waiting for reassurance from provincial officials on another major financial challenge: the loss of development revenue due to Ontario’s housing legislation: announced in 2022, the More Homes Built Faster Act (Bill 23) requires the City of Toronto to build 285,000 homes by 2031 and provides exemptions and reductions in development fees (which were borne by builders) for non-profit rental homes, affordable and purpose-built. The City used this revenue associated with new construction to fund municipal improvements that new projects typically require, such as water and sewer systems in an area. Well: according to the city’s latest report on the impact of the provincial bill, the loss of development charges will cost Toronto $2.3 billion over 10 years, or about $200 million a year in lost revenue. The Province has given assurances that it will compensate the City for revenue losses associated with real estate development, but it is unclear how, and Mayor Olivia Chow’s office disclosed a couple of days ago that “the mayor expects the Province honor your commitment”.

Then there is the federal front: both Mayor Olivia Chow and Ontario Premier Doug Ford have asked the government to provide more funding to the City on several fronts. In fact, the Province has subordinated part of the financing of the new agreement to matching funds from the federal government. While Ottawa has shown some willingness to come to the table in terms of housing funding through its federal Housing Accelerator Fund and some shelter funding commitments, it remains to be seen whether the government will commit to providing matching funds.

Meanwhile, Toronto City Council has already begun exploring options to generate revenue, voting for phased increases in the land transfer tax on homes over $3 million, an increase in the vacancy tax and the removal of a five dollar per hour parking limit. Toronto taxpayers could see a property tax increase in the next budget, although the exact percentage is still being worked out.

In a recent interview with CP24, Chow said she didn’t want to preempt the Budget Committee’s work, but said “this will all be resolved by mid-February”. Public consultations on the budget were held in November, and city officials said they would help determine funding priorities in the budget, as well as the tax rate.

Professor Matti Siemiatycki, director of the Infrastructure Institute at the University of Toronto, told Cp24 that even if the City will probably have to make difficult choices, it won’t have to scrounge to replace the lost development charges on its own. “I think the Province and the municipalities will eventually reach an agreement on revenues from property development and their integration” he said. “Partly because there was a commitment that they would be renovated, partly because it is also essential for the Province to build more housing”. However, the extent of the impact on the City will depend on the timing. “I think they will eventually reach an agreement. The question is: how long will it take and how harsh will it be to get there?”.

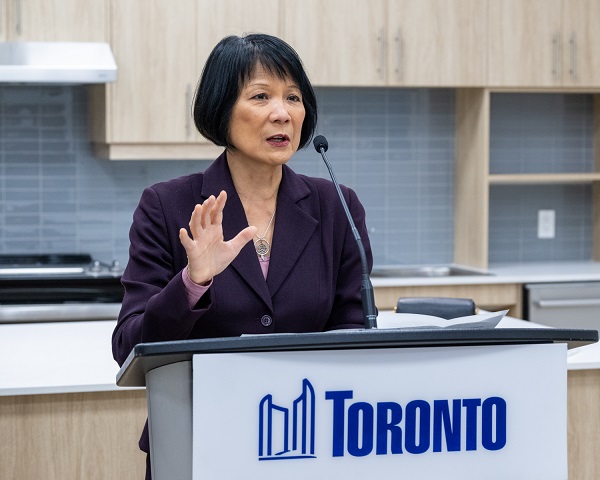

In the pic above: Toronto Mayor, Olivia Chow (photo from Twitter X – @MayorOliviaChow)